The interview: Robyn Saranah, general manager of Commonwealth Private

Robyn Saranah says the bank’s clients are incredible humans, with incredible stories.

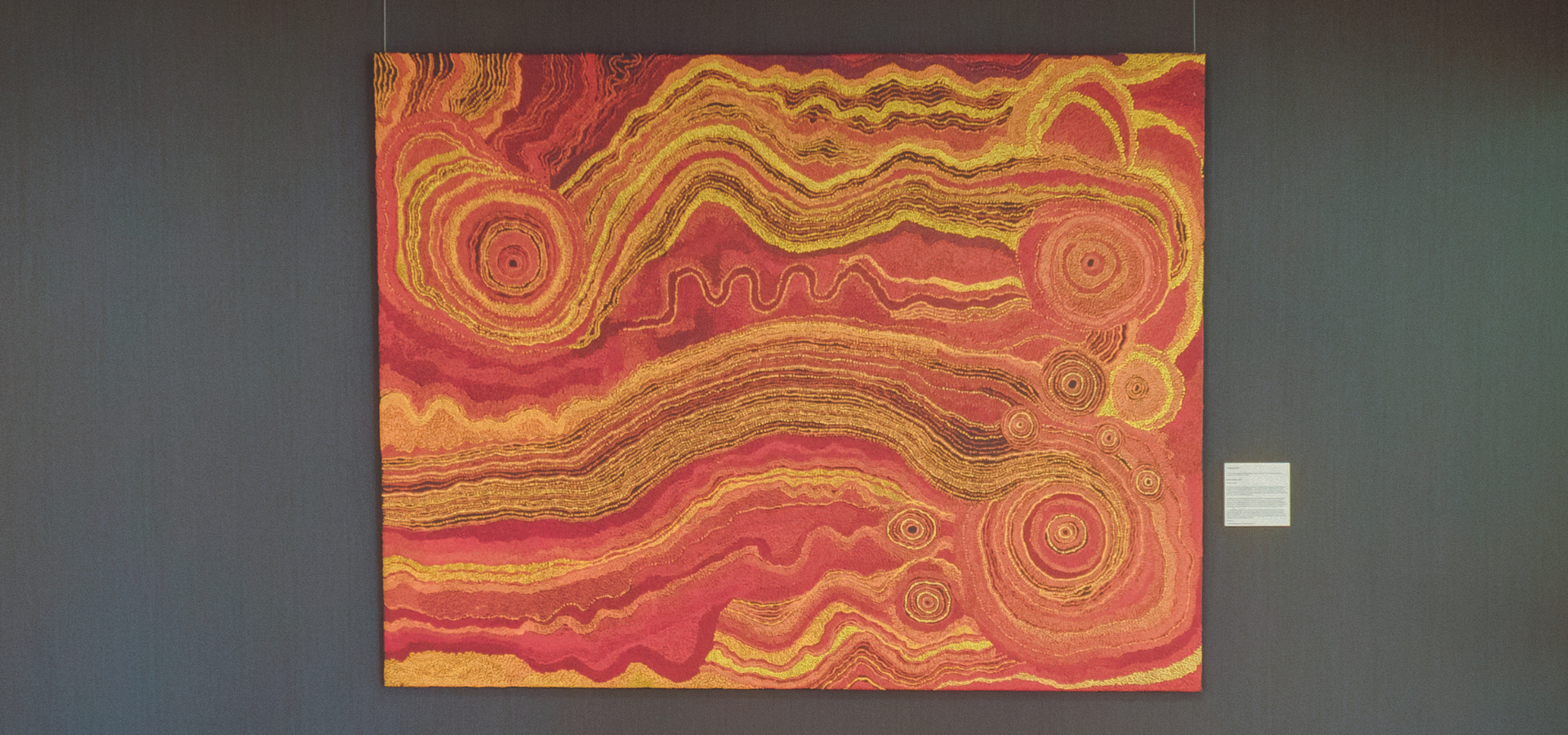

Above: Seven Sisters by Tjungkara Ken, a Pitjantjatjara artist from Amata, South Australia.

The modern headquarters of Commonwealth Bank is, on entering, an airy, atrium-like affair that feels less like the lair of a financial Goliath and more like a chic Scandinavian convention centre, with its second-floor concierge and huddles of event attendees, its sprawling array of meeting and luncheon and entertainment spaces serviced by in-house caterers and a phalanx of directional staff, its profusions of glass and greenery and sustainably sourced native woods, not to mention its long corridors of important Australian art pieces.

Robyn Saranah, similarly, is not your cookie-cutter captain of banking industry, albeit a veteran of said industry and since 2020 the general manager of Commonwealth Private. “I’ve worked in many areas of banking – institutional, corporate; I’ve run commercial and banking businesses – and in those areas, you can spend three years managing an institutional customer, get to know everyone, but you don’t get past the business,” she says. “And then you come into what we do in the private bank, which is actually about the human and their story and their hopes about the future, and the trust they share with you. They see you as a partner of their family. And the intimacy you get is a surprise – and an incredible privilege.”

We meet after a week laden with economic headlines, in which the central banks of the US, UK, EU, India and Australia, among others, all raised rates and cratered markets. But where most bankers were steadfastly talking inflation and outlooks, Saranah steers towards values and connections – in an approach that appears to define her take on the private bank itself.

“It’s about bringing communities together. Communities of people who are thinking alike, who have similar value sets,” says Saranah. “In life, and in business, people look for great partners. And the best role we can play is to identify those individuals and place them in a room together, and the rest just happens.”

Which goes a way towards explaining the not especially bank-like headquarters, the convention centre atmosphere, and, equally, the distinction between run-of-the-mill banking and the country’s largest private bank. For Saranah, it’s less about the services you’d expect, which her team and the wider bank can doubtless accommodate, and more about the value-add of community. And that goes doubly in the current climate of economic uncertainty.

“Our role right now is to get clients the right information – not what they can read on any newsfeed; they’re wanting a much deeper insight,” she says. “They’re looking for direction. They’re looking for great people around them to guide them. And that’s the power of connection – not just what we can provide them from a business perspective, but what we can provide them in terms of connections. Entrepreneurs have that spirit in them, and when they listen to like-minded people who have been through these economic situations in past cycles, that’s where they take that thinking and apply it to their own value set.”

Saranah sees it as a pivotal moment – not only in terms of the changing economic conditions, but also in the context of Australia’s new cohort coming into the second generation of wealth.

“Australia is such a young country, and the exciting thing for me is that it’s really the first transition of wealth for this nation, and we’re writing the script as we’re going, but we’ve also got the benefit of learning from countries in Europe, from the States.

“There’s a number of different roles the bank needs to play,” Saranah continues, “and one of them is around financial literacy and governance. A lot of our clients are worried that their children are not financially literate enough to protect and grow their wealth.

And they expect us to play a bigger part in this education. Another role is very much around how they access capital and funding in different models; and then, how do we connect them with others who’ve been through that journey.”

Alongside this first, tidal transition of Australian boomer wealth, there’s the new cohort of tech money that upends traditional banking models – and plays straight into the human element of Saranah’s private banking practice.

“The traditional picture is that you go from one stage to the next stage of wealth creation; but now wealth creation can happen almost immediately – within five years you’ve got someone who’s 26 years old, who’s a gamer, who’s come into all this money and needs all this help,” says Saranah. “So part of it is learning about them and their industry, and who in our team is going to be the right human fit for that client – it’s not going to be someone who’s been supporting the baby boomers. And then there’s the solutions we can offer.

“These emerging UHNW customers, they’re young, and their goals are very different,” Saranah continues. “They’re about sustainability and self-actualisation. Even from an investment perspective, their appetites, their profiles, are very different from the baby boomers. I think psychological profiling is going to be more important in the investment space. The values are changing. And it starts with that, with understanding their values. What are their hopes for the next generation, and how we can play to that.”

Banking as self-actualisation: it would be a stretch coming from most finance types. But as the conversation moves from the bank’s recent art events introducing Archibald Prize-winners to a new generation of collectors, to wealth as freedom, to lifestyle and second homes (“The dream home for me is in Wanaka near Queenstown – those elements of nature have a huge influence for me”), to entrepreneurship and purpose, and on to vulnerability and grit, Saranah herself actualises this almost disarming role of the private bank in supporting individuals and families to realise their deepest ambitions – across generations.

“It’s a privilege to be in a position where clients open up with their stories,” she says. “We’re all human. Whatever happens in the world, at the centre of it is a human. Whatever the situation, it will come down to curiosity, listening, asking questions.

“People often say to me that my role must be challenging,” Saranah says. “But our clients are incredible humans. Their stories are incredible.”