Australia

Cabarita Rd, Avalon Beach, NSW 6 br | 17,610 sqft POA

3 Calabash Road, Arcadia, NSW 5 br | 11 ha $8,000,000 AUD

4 Ranelagh Rd, Burradoo, NSW 30 br | 5 ha $12,000,000 AUD

181-199 Matthews Rd, Leopold VIC 15+5 br | 37 acres POA

Bunker Bay 0 br | 9,139 sqft POA

1-2 Adare Ct, Berwick VIC 4+2 br | 43,087 sqft $7,000,000 AUD

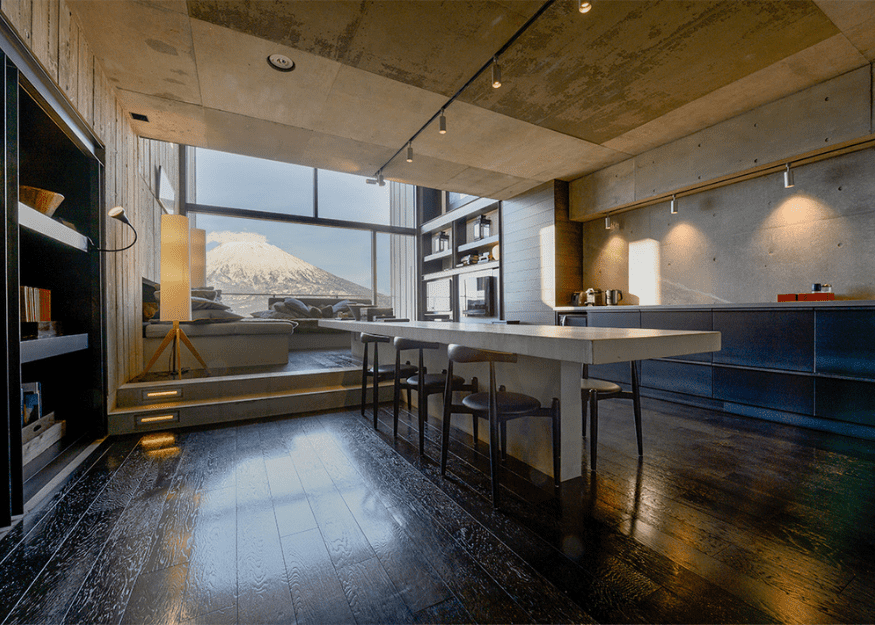

Japan

Grand Hirafu, Kutchan, Niseko 2.5 br | 982 sqft POA

756-60 Aza Soga, Niseko 3 br | 5,339 sqft $1,301,000 USD

Ginto Hirafu, Hokkaido 5 br | 25,876 sqft $6,500,000 USD

Suiboku Hirafu, Kutchan, Abuta District, Hokkaido 3 br | 1,662 sqft $2,460,000

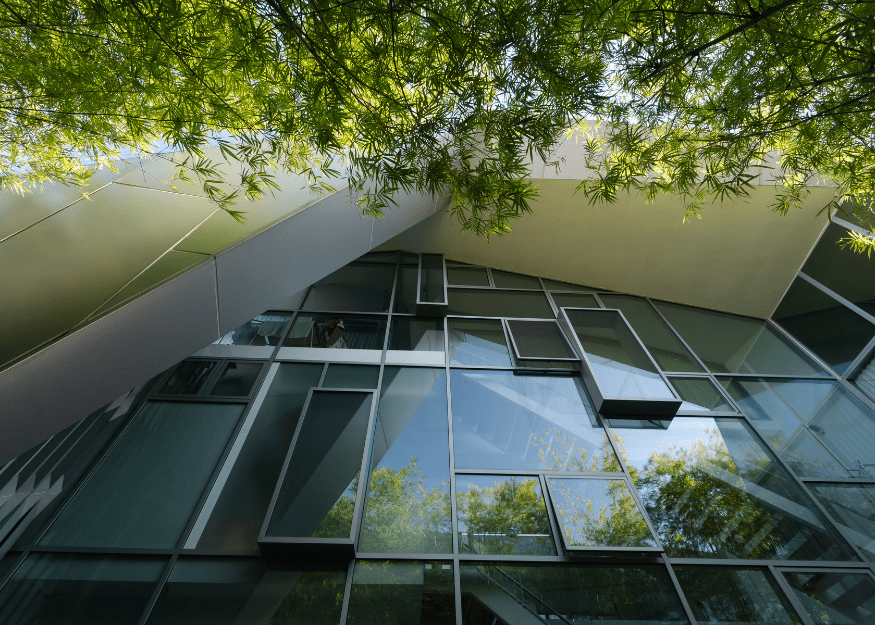

Singapore

Ocean Drive, Sentosa, D04 4 br | 7,167 sqft

65 Cairnhill Rd, Cairnhill, D09 3.5 br | 2,831 sqft $15,200,000 SGD

9 Nassim Rd, D10 4 br | 3,422 sqft $12,800,000

Ocean Drive, Sentosa, D04 5+2 br | 7,600 sqft POA

57 Cove Way, Sentosa, D04 4 br | 6,631 sqft $21,800,000 SGD

Bin Tong Park, D10 br | 21,000 sqft POA

Thailand

Pa Klok, Thalang District 10 br | 117,908 sqft POA

300 Charoen Krung Rd, Yannawa, Sathon 1-5 br |

Avadina Hills by Anantara, Phuket From 2 br | 35,166 sqft $347,000,000 THB

Lang Suan Rd, Lumphini, Bangkok 1 br | 904 sqft POA

Soi Ton Son, Lumphini, Pathum Wan 3 br | 2,314 sqft POA

United Arab Emirates

Marasi Drive, Dubai 4 br | 7,934 sqft $13,620,000 USD

Pagani Residences FROM 2 br | 1,784 sqft $6,500,000 AED

The Opus From 1 br | 877 sqft $1,074,000 USD

Medhufaru Island, Manadhoo, Maldives 1+1 br | 4,424 sqft $6,225,000 USD

Waves End, Newport Beach 6 br | 23,458 sqft $35,000,000 USD

Tourist Rd, Glenquarry, Southern Highlands 4+5 br | 100 acres POA

Coral Cay, Newport Coast 5 br | 12,536 sqft $10,995,000 USD

Gilwinga Dr, Bayview, Sydney 7 br | 348,480 sqft POA

Kurraba Point, Cremorne 3 br | POA

11 Stamford Road, City Hall, D06 4.5 br | 5,964 sqft $22,500,000 SGD

153 Cove Drive, Sentosa, D04 4 br | 4,800 sqft $22,000,000 SGD

155 Cove Drive, Sentosa, D04 3 br | 2,723 sqft $8,800,000

Bukit Timah 6+1 br | 19,700 sqft POA

Ocean Drive, Sentosa, D04 6 br | 8,200 sqft $18,000,000 SGD

Darling Island Rd, Pyrmont 4+2 br | 4,754 sqft POA